Understanding Exactly How Credit Scores Repair Functions to Boost Your Financial Health

The process incorporates recognizing errors in credit scores records, contesting mistakes with credit scores bureaus, and discussing with lenders to address impressive financial debts. The question remains: what particular methods can people employ to not just remedy their credit history standing but additionally make certain enduring monetary security?

What Is Credit Report Fixing?

Debt repair service describes the process of boosting a person's creditworthiness by dealing with inaccuracies on their debt record, bargaining debts, and embracing far better economic habits. This complex approach intends to improve a person's credit rating, which is an important element in securing loans, charge card, and positive rates of interest.

The credit history repair process typically begins with a detailed evaluation of the individual's credit scores report, permitting the identification of any mistakes or disparities. The private or a credit scores repair work specialist can launch disputes with credit scores bureaus to fix these concerns when errors are determined. Additionally, working out with creditors to resolve outstanding financial debts can further boost one's financial standing.

Additionally, adopting prudent financial practices, such as timely costs settlements, decreasing debt application, and preserving a varied credit history mix, contributes to a much healthier debt profile. Generally, credit history fixing functions as a necessary strategy for people looking for to reclaim control over their monetary wellness and secure better borrowing chances in the future - Credit Repair. By involving in credit scores repair, individuals can lead the way toward attaining their economic goals and improving their total top quality of life

Common Credit Report Report Mistakes

Errors on debt reports can considerably influence an individual's credit history, making it important to comprehend the common kinds of errors that may develop. One common concern is wrong individual information, such as misspelled names, wrong addresses, or incorrect Social Safety numbers. These mistakes can bring about complication and misreporting of creditworthiness.

One more typical error is the reporting of accounts that do not belong to the person, usually as a result of identity theft or clerical errors. This misallocation can unjustly reduce a person's credit rating. In addition, late payments may be incorrectly taped, which can occur because of payment processing mistakes or incorrect coverage by lenders.

Credit rating limitations and account balances can also be misstated, leading to an altered view of an individual's credit scores utilization proportion. Awareness of these common mistakes is crucial for reliable credit scores monitoring and repair work, as resolving them promptly can help individuals maintain a healthier economic account - Credit Repair.

Steps to Dispute Inaccuracies

Challenging errors on a credit scores record is an important process that can help restore an individual's credit reliability. The initial step entails obtaining a present duplicate of your credit report from all 3 significant credit scores bureaus: Experian, TransUnion, and Equifax. Review the report carefully to identify any errors, such as inaccurate account info, balances, or repayment histories.

Next off, launch the conflict process by contacting the pertinent credit report bureau. When sending your conflict, clearly detail the mistakes, supply your evidence, and consist of individual recognition info.

After the dispute is submitted, the debt bureau will certainly check out the claim, typically within 30 days. Keeping precise records throughout this process is vital for reliable resolution and tracking your debt health.

Building a Strong Credit Rating Profile

How can people effectively grow a durable credit report account? Building a strong credit history account is vital for securing positive financial possibilities. The foundation of a healthy and balanced credit history account begins with timely expense payments. Regularly paying credit rating card costs, lendings, and various other responsibilities on schedule is critical, as payment background significantly affects credit history.

Additionally, maintaining low credit rating application ratios-- ideally under 30%-- is crucial. This suggests keeping bank card equilibriums well listed below their restrictions. Diversifying credit rating types, such as a mix of rotating debt (charge card) and installation lendings (automobile or mortgage), can additionally boost credit report accounts.

Consistently keeping an eye on debt records for inaccuracies is similarly important. Individuals ought to assess their credit report reports at least yearly to determine disparities and dispute any mistakes promptly. In addition, staying clear of excessive credit history inquiries can prevent potential unfavorable impacts on credit rating.

Long-lasting Advantages of Credit Scores Repair Service

In addition, a more powerful credit rating profile can facilitate much better terms for insurance coverage costs and even affect rental applications, making it less complicated to safeguard housing. The emotional benefits must not be neglected; people who successfully fix their credit history often experience reduced anxiety and improved self-confidence in managing their finances.

Conclusion

In final thought, credit history repair work serves as a vital system for enhancing economic health internet and wellness. By determining and disputing mistakes in debt reports, individuals can rectify errors that adversely impact their credit history scores.

The long-term advantages of credit scores repair expand far past just boosted credit score scores; they can considerably boost an individual's general economic health and wellness.

Jake Lloyd Then & Now!

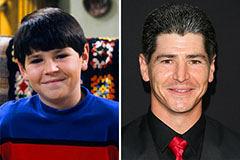

Jake Lloyd Then & Now! Michael Fishman Then & Now!

Michael Fishman Then & Now! Sydney Simpson Then & Now!

Sydney Simpson Then & Now! Teri Hatcher Then & Now!

Teri Hatcher Then & Now! Ryan Phillippe Then & Now!

Ryan Phillippe Then & Now!